October Market Update

Understanding the current market can be confusing right now. Especially if you're looking to buy or sell a home.

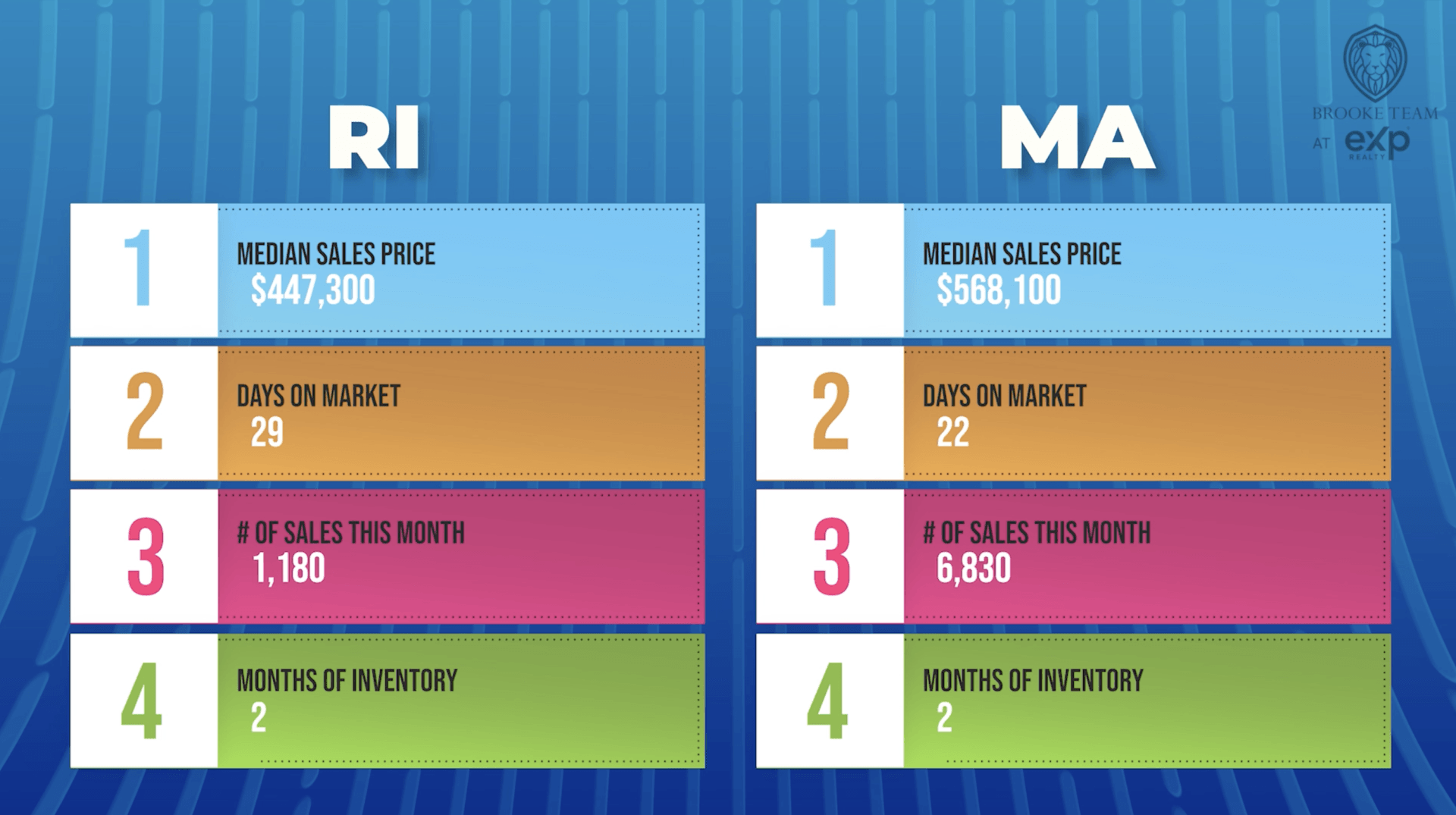

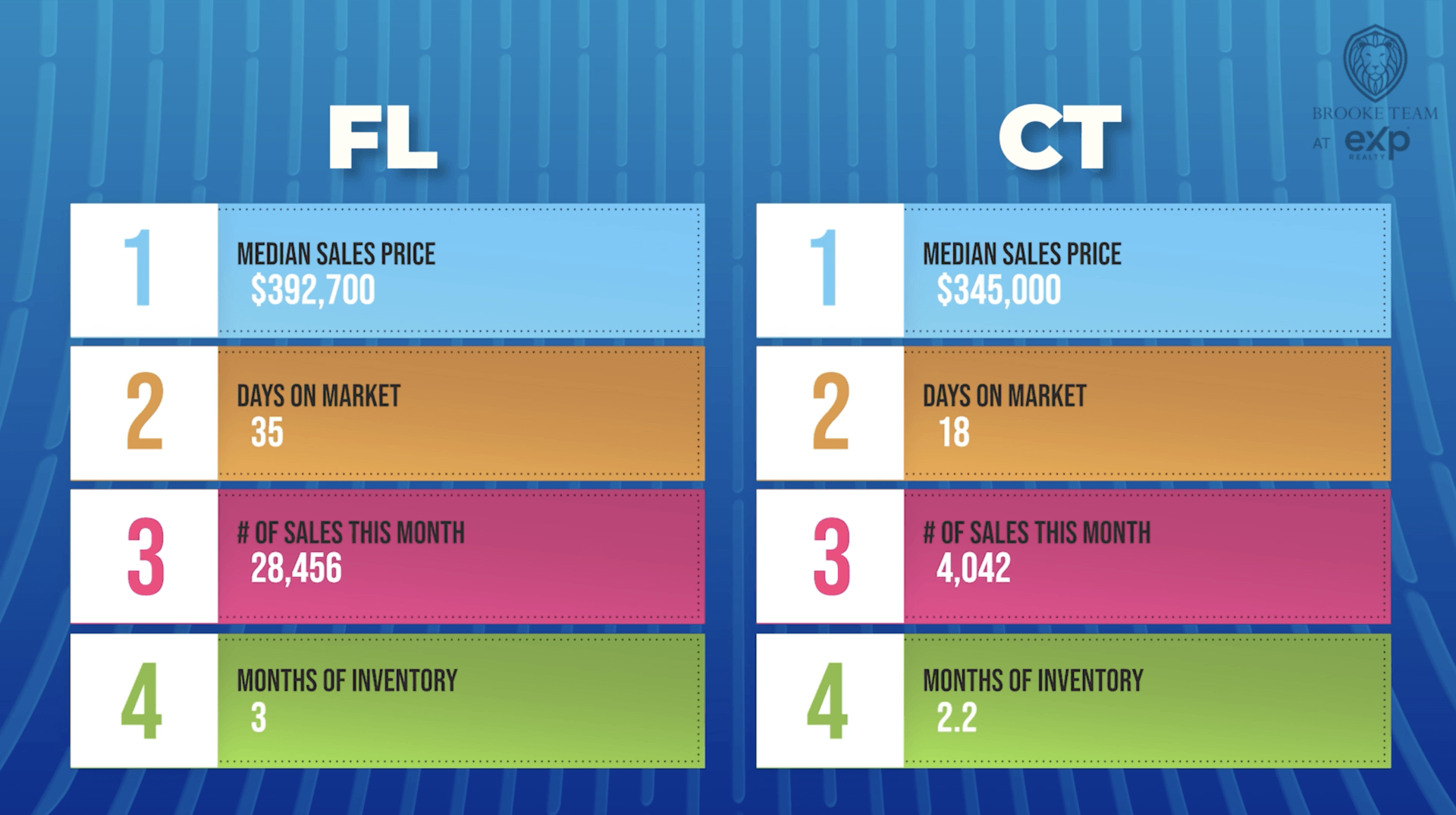

Is it a good time to sell because the inventory is low? Is it a bad time to buy because of rising interest rates?

Timing a sale for the best price or the lowest interest rates can nearly seem impossible and the biggest thing is bottom line…nobody wants to make a mistake. Because we are getting these questions more than ever before, we thought we'd answer them with this fun interaction.

Seller: Are home prices still at an all-time high and there's still multiple offers? I’ve got to get my house sold.

David: Totally understand. Lots of sellers are asking us this right now. What we're seeing is that many buyers are actually getting priced out of the market right now due to rising interest rates and we see that some sellers are pricing as if it's June rather than if it's October.

Seller: Gosh, so why am I seeing price reductions?

David: Well, just that if a seller is actually looking back at a higher demand market, and all of a sudden they price their home as if the market is going to increase, then they're probably going to see a price adjustment

Seller: Okay. I could remember in previous market updates, you told me the market wouldn't crash.

David: I know that's right, and it really hasn't crashed. Instead, it's actually just cooling as it does cyclically in the fall time and in winter time, as opposed to the spring and summer. The key here is that we're getting back to normal interest rates and normal supply and demand levels.

Seller: Okay got it. That makes sense.

Buyer: Okay, David, I'm definitely not paying 7% interest rate for my mortgage.

David: Okay, but the rent you're paying is a 100% interest…

Look, so the price of money and the price of the houses are higher than they have been in nearly a decade, so it can feel like you're overpaying and I understand. The biggest thing that I would just suggest is don't buy a house or pay for a mortgage that's outside of your comfort zone. Do the math and meet with your financial advisor to see what is acceptable for you and then set up a buyer consultation with me to decide what our next steps are going to be.

Buyer: But what if I buy and the market takes a dip? I think I’m going to wait.

David: Look sometimes waiting is actually the best option, but let me just say this:

If the government has already said that they're going to continue to increase interest rates over the next several months, then waiting for interest rates to calm down probably isn't going to serve you best over the next few months. However, if prices do cool in the cyclical market, as they do in the fall and the winter, actually now might be a great time to get a home for a little bit cheaper than you thought. Then, later on down the line, you could refinance as interest rates eventually will probably recede.

It's an interesting time in the real estate world and no matter what happens in the future, we're committed to giving you the information that you need in order to make the best-educated decision.

We'd encourage you to reach out whether you're looking to buy, sell or invest in real estate, and remember, we're never too busy to serve your referrals. Find on us Facebook, Instagram, and YouTube.