August Market Update

So, what does recession actually do to a housing market?

Well, you’d actually be surprised that, in the last six recessions, we actually saw an increase in home appreciation. That's right, in the last three out of six recessions, we actually saw around 6% of home prices appreciation. So, why are people so concerned about a recession when it comes to housing? Well, it's just human nature that we look back to the last thing that happened, which was 2008 for a recession, and we actually saw this massive, about 20% decrease in home prices. Don't take my word for it. Check out core logics data right here and they'll show you the last six recessions.

Okay. So what's that mean? It likely means that as we continue to go into these next few months, the government, although they're having a little bit of trouble with runaway inflation and they're also having trouble remembering the definition of a recession, they're actually doing a really good job by increasing the interest rates which is combating this inflation. So what do I do if I'm a seller? There's a lot of fear out there that, you know, “Maybe I missed the market”. You didn't miss the market. In fact, the numbers are showing that median sales prices are continuing to increase. And so if you're likely going to see any decrease in pricing, it's probably just going to be due to the typical cyclical market where it cools in the wintertime and actually increases in the springtime.

So, over the next few months, you're likely to see the market cool slightly but demand is still really strong. Although people may pull back due to some interest rate increases, we really are working around that through a lot of buyers buying down their interest rates.

Now, what do I do if I'm a buyer in the market?

Well, if you're a buyer in the market, and you're waiting for prices to cool, calm down, or even crash, I think you're probably taking the wrong approach. If you look at some of the numbers for what's been happening in the market recently, we've only seen pricing increases over the last several months.

So what should I do if I'm a buyer?

Well, a few things. Number one, if you’ve actually started to look for a home in the past few months, but you stopped maybe because of rising rates or due to inflation even; we've actually seen some rates start to come down at certain segments and for certain loan products, so it would be a great time to reach back out and recalculate where you are. We're also seeing that some houses are not immediately selling for significantly over list price and so it might be also a great time to get back into the marketplace and recalibrate where you're at. Again, we'd never want to suggest buying something that's not within your financial comfort zone, so now might be a great time to recalibrate that.

But if you're a seller what should you do as well? Well, now we're seeing that there's more available in the marketplace and so it's also a great time to reach out and talk about some of the options that may be available that are out there, considering that your home might take just a little bit longer to sell than it normally has.

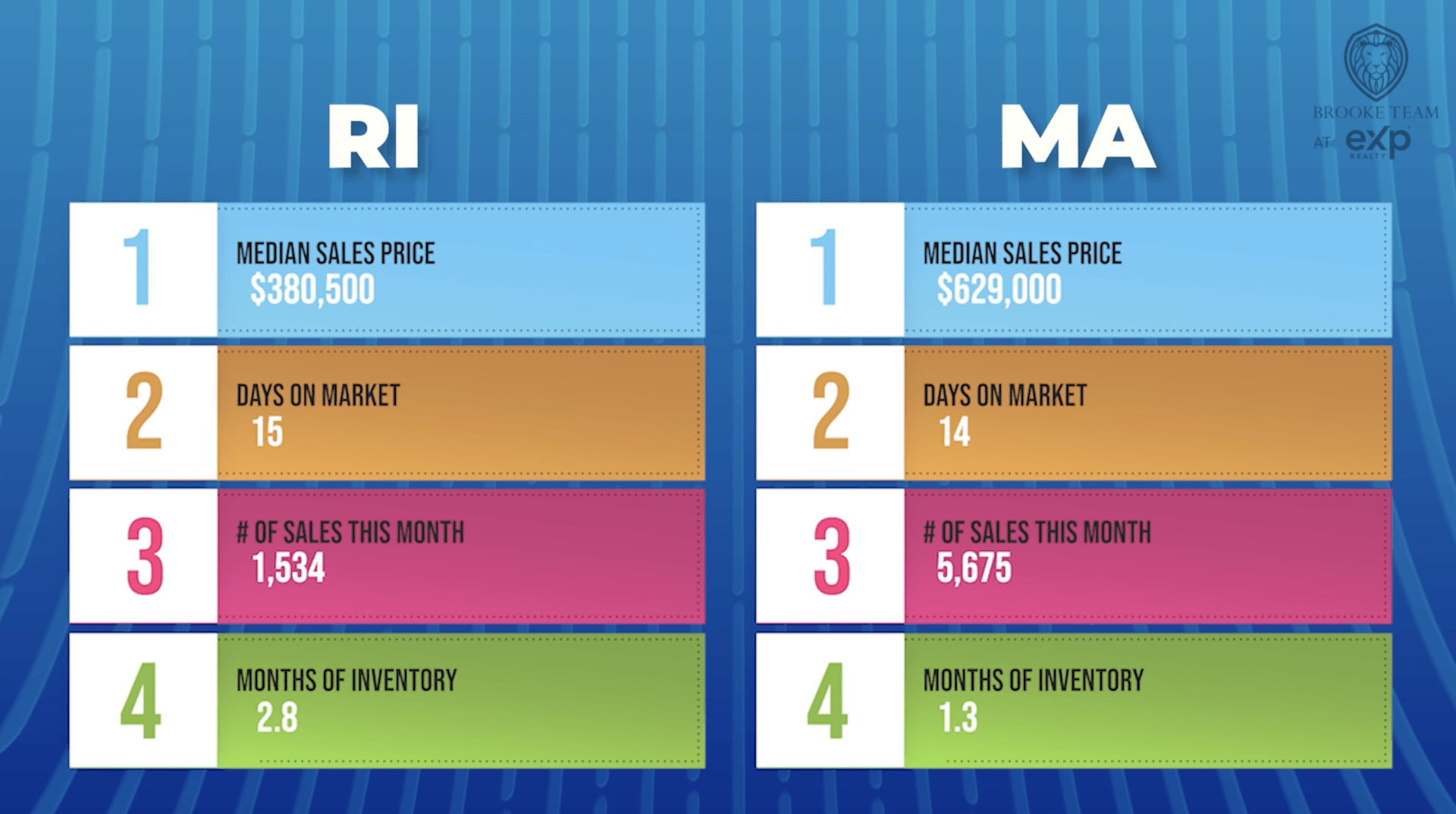

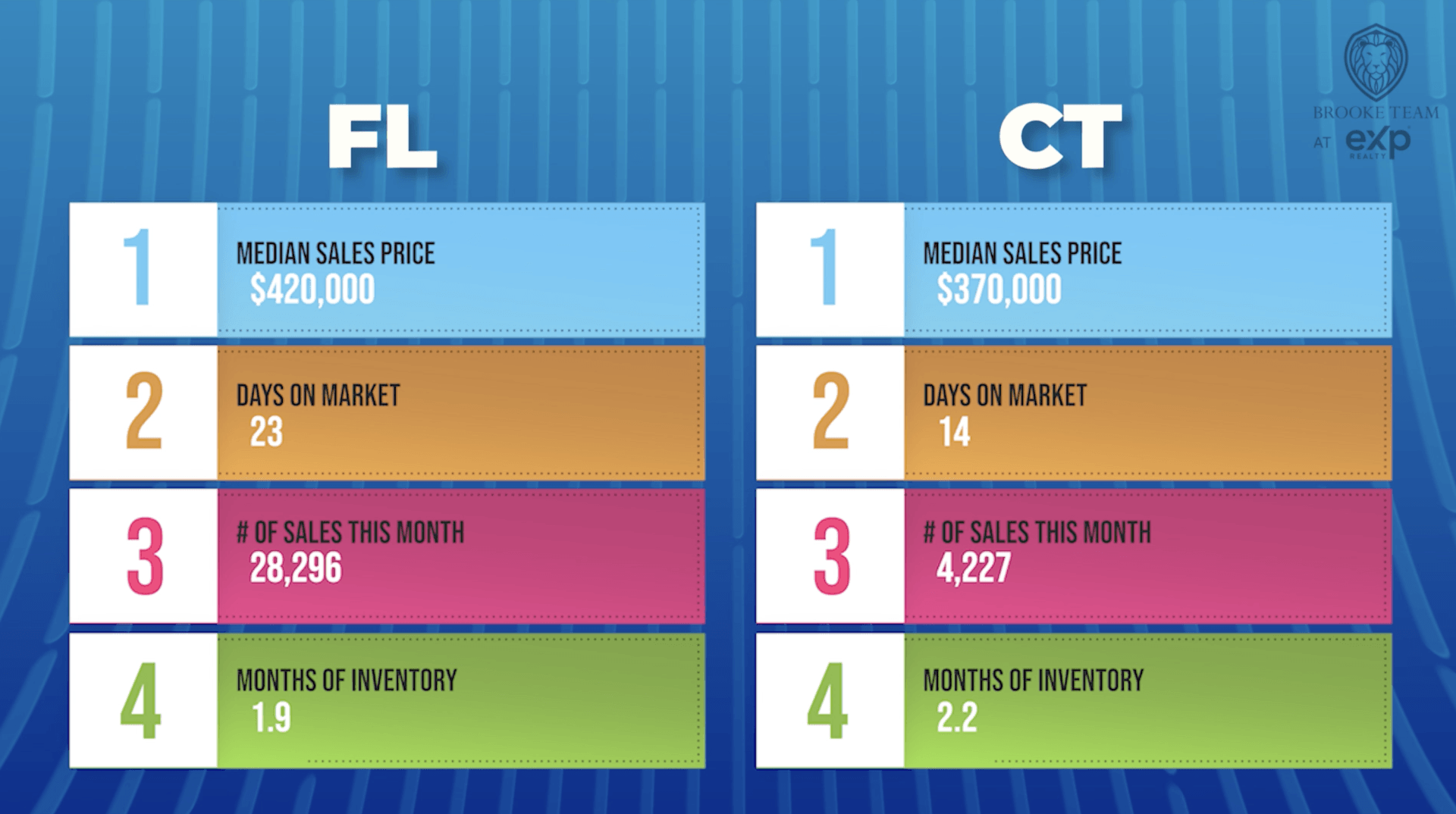

Don't just take my word for it; check out the latest MLS numbers from Connecticut, Massachusetts, Rhode Island, and Florida.