July Market Update

The real estate market has been extremely hot lately, but it's actually cooling off. Just like it's the best time to have ice cream during the summer. Well, now, all of a sudden, the real estate market is taking a cool and there are two things that could happen: either a complete mortgage meltdown or stabilization. Here's what's going to happen.

What is stock meltdown?

What would happen if the mortgage market melted down? Basically, as interest rates continue to rise and people want to refinance their properties, they likely bought them over the past several years at 3% interest rates, but now as they go to refinance, they’re looking at 6-7 and even 8% interest rates.

Why is this happening? Simply because the government, as we've discussed before, is increasing interest rates in order to combat runaway inflation. If that occurs, we could see interest rates reach the 7s and 8s very quickly. In fact, just last week, the federal government raised interest rates another one percent overnight.

So how does a meltdown occur?

Towards the end of the year, many families will likely decide to refinance in order to consolidate their debt. For some families, that's possible because they have a lot of equity in their property but they're going to be looking at refinancing from likely three and four percent interest rates all the way up to six, seven and eight percent interest rates. That may be able to be possible if their wages will match that, but for many families across America, that's not an option.

This also applies to people who have purchased properties recently; they might not have the equity in the home in order to substantiate a refinance, in which case, we could see a lot of defaults happen in the real estate industry. If mortgage companies start to see many defaults on their books, they could essentially start to close and we're already seeing that happen today.

Let's talk stabilization

This is what we all want. It's called the “Soft Landing” that the U.S. government is proposing. In this, the federal government would actually raise interest rates in order to combat this runaway inflation. Buyers and sellers would just assume that this is part of the buying process now and they'd actually be able to just get accustomed to it. In the theory of stabilization, we'd actually see more Americans with more in their bank accounts than before, simply because they're not spending as much and they're retracting their spending due to inflation.

Recent articles just came out where JPMorgan Chase Bank stated that their customers have more in their checking accounts than ever before. This could be because people are not frivolously spending or using their excess cash towards things that they don't need, instead of focusing on the basics. In this regard, refinances as much as possible wouldn’t be necessary and people would just start to get accustomed to interest rates that were at more normalized levels. If stabilization occurs, we likely wouldn't see prices start to drop so dramatically. In fact, we'd actually start to see price and value get a little closer together, which is where I think things are going.

So as much as these are predictions, here's what we know is happening. Right now, there's a difference between price and value. What I mean by that is if a property is on the market for $700,000 and there's three or four or maybe even ten buyers who want to purchase the property, buyers will ask, “where is the market going?” They'll then say they’d want to pay maybe 720k, 730k, or even 770k for the property. The bank would send out an appraiser to say, what the property is worth. In the event that they say it's worth 700k, the buyer would then bring the difference of $70,000 to the closing table. This is called an appraisal gap. This is the difference between price and value.

Many people are suggesting now that the market is starting to cool and that actually there may be a crash. They are watching prices drop but what's actually happening is that disparity between value and price is actually getting closer together. What that means is that although there's other buyers who are interested in properties and we still see multiple offers, we’re likely seeing those prices start to get closer to price and value meeting.

Does this signal an absolute mortgage meltdown?

So is this suggesting that the real estate market is crashing? No. We believe that this is actually getting towards stabilization and normalization, not only for the real estate market, but also for the mortgage market. We're really seeing a lot of opportunities for both buyers and sellers in this market.

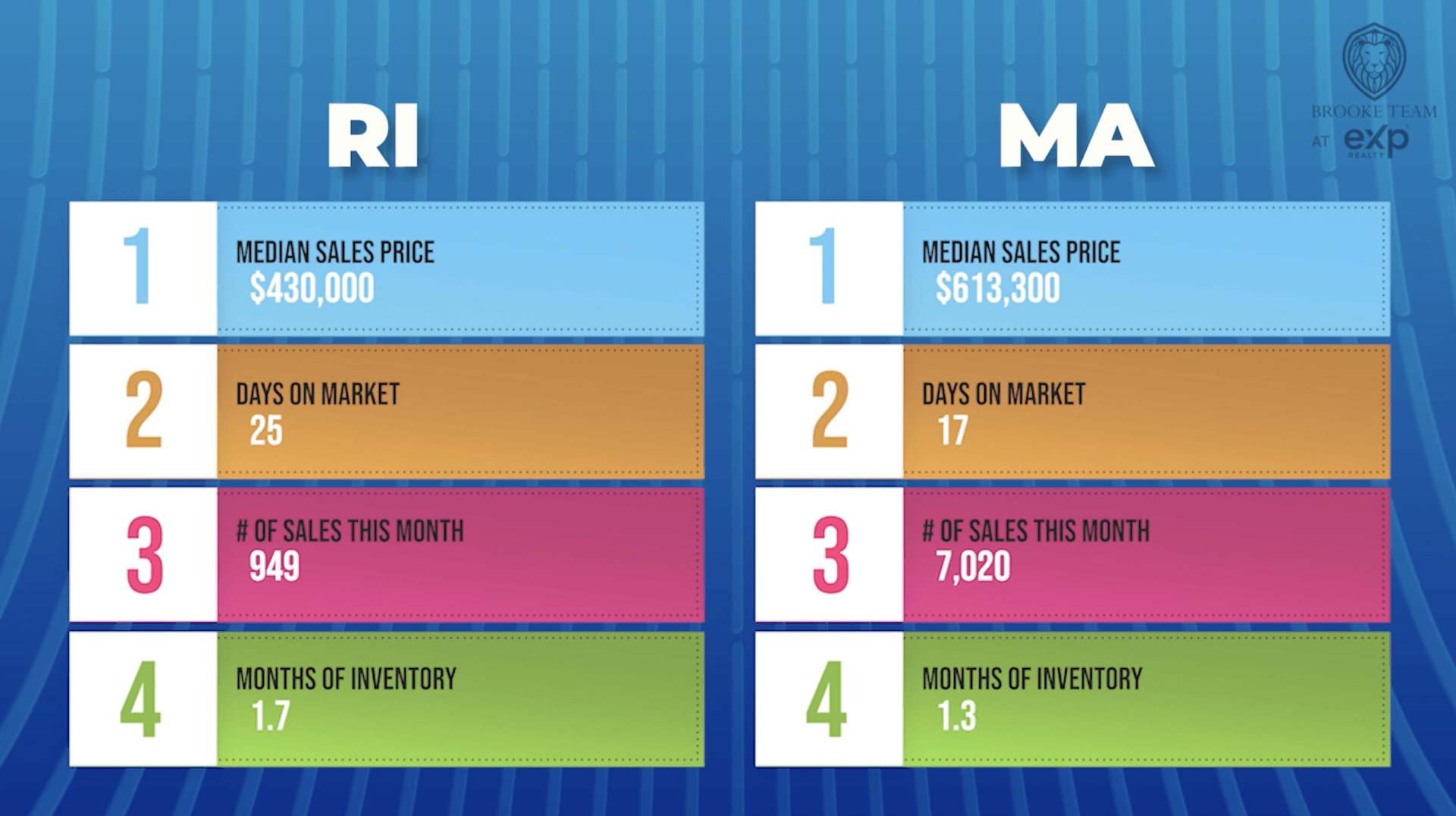

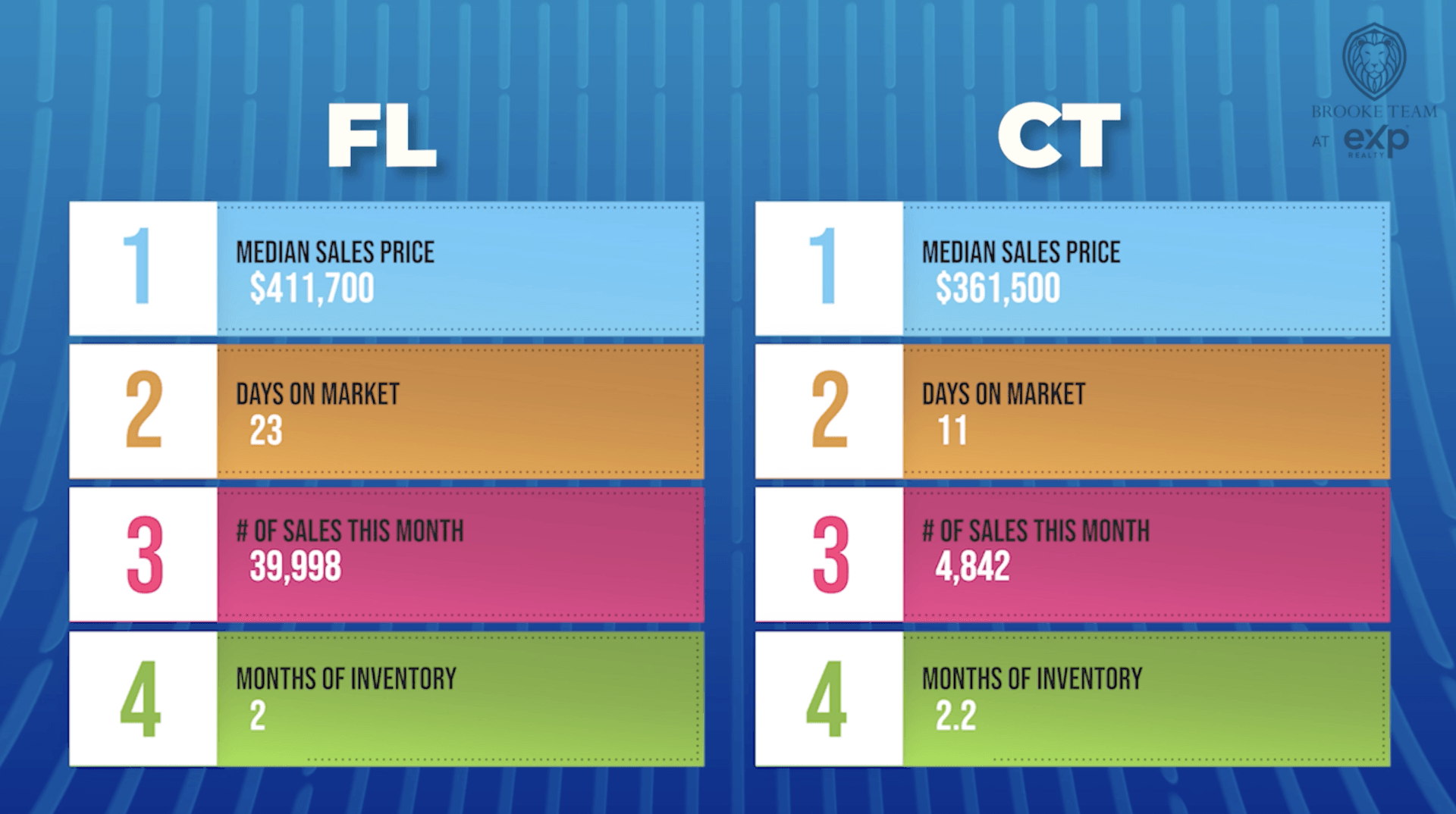

And now, let's talk about the real estate numbers for what's happening where Brooke Teams are located across the country in Connecticut, Massachusetts, Rhode Island and Florida.